- Best expense for personal expenses in quickbooks how to#

- Best expense for personal expenses in quickbooks professional#

- Best expense for personal expenses in quickbooks free#

A credit card type account could be created to account for the transactions as discussed in the section on Credit Cards and the name of the account could be Due to Owner-Short Term or similar description.

Best expense for personal expenses in quickbooks professional#

Clients should consult their tax professional if they are unsure of the proper account. The account to be credited can be a Loan from Shareholder account if loan documents have been drafted or Owners Contribution, an equity account, if the expenses are considered capital contributions. While the expenses paid will be debited, the account to be credited can vary depending on the legal structure of the business.

Best expense for personal expenses in quickbooks how to#

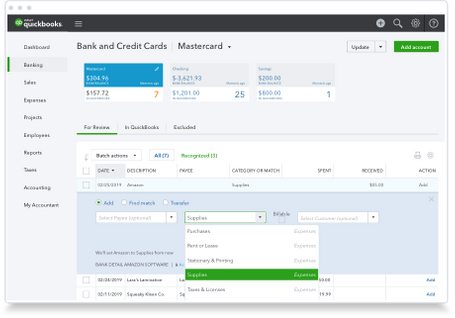

Ill share with you the steps on how to handle a personal expense in a business account in QuickBooks Online (QBO). how do you record that under expenses.as im not a vendor/customer. If the owner cannot reimburse themselves in the short term, a journal entry can record the expenditures. How do i record my expense of owner pay and personal expense - when i pay myself.If the client is paying the expenses immediately, users can write a check to reimburse the owner for the business expenditures paid for with personal funds.How quickly the business will repay the expenses can determine the best way for the client to record the transactions. These expenses can be recorded in QuickBooks ® in one of several ways. By photographing a receipt, whether it’s for gas or a client lunch put on a company credit card, employees can easily get their expenses approved. With that being said let us check out 'How to record Accrued Expenses in QuickBooks' Accrued Expenses unlike cash accounting comes into the picture when income is earned and expenses are incurred. As we’ve mentioned, you need to create a daily routine and habit of recording and tracking your personal and business expenses in QuickBooks.

Unlike paid competitors like FreshBooks and QuickBooks Online, Wave Accounting doesn’t have an accounting-specific mobile app (though it does have separate receipt, invoice, and payment. Thanks to QuickBooks it isn’t actually that difficult to track your personal and business expenses you need only to get into the habit of strict bookkeeping practices.

Best expense for personal expenses in quickbooks free#

With Expensify, employees can expense purchases with the click of a button. As one of the best free expense tracker apps, Wave lets you track unlimited expenses and scan an unlimited number of receiptswhile paying nothing, ever. The criteria used to choose the best receipt scanning apps included ease-of-use, quality of scans, OCR functionality, and user reviews. You can record a personal expense recovery as a check or an expense. Although it is recommended that company and personal funds be kept separate, we understand that this does not always happen. Frequently, business owners will pay for business expenses with personal funds. Expensify is one of the best QuickBooks add-ons, and for good reason. How to Record Business Expenses Paid with Personal Funds in quickbooks is the subject of this article.

0 kommentar(er)

0 kommentar(er)